You have an education loan, home loan or personal loan to pay and the rate of interest on these loans is higher than the rate of interest you will get for your savings. Should you save or invest or pay off your debt first?

You too will face this dilemma unless you are either too rich or in the beginning of your professional life.

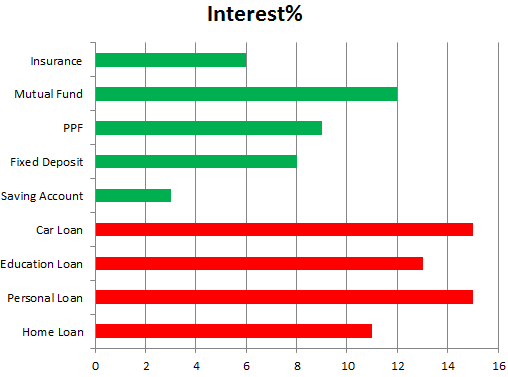

Interest that you pay

- Home loan: 11% to 12%

- Personal loan: 15%

- Education loan: 13% to 15%

- Car loan: 15% to 17%

Interest that you get

- Saving Account: 3% to 6%

- FD: 8% to 10%

- PPF: 9.5 %

- MF: 12% to 15%

- Insurance: 6% to 8%

If you notice this list, interest that we pay is much higher than interest we get on saving and investment so financially it may make most sense to pay-off our debt and then start saving. However, …

Other points to consider before just paying off your debt

- Paying off debt may take 3 to 15 years. What if you need some corpus for medical or personal emergency? The liquid instruments should be available even when you are covered by medical and term insurance policies.

- Availability of money gives immense satisfaction and sense of security.

- If you save even a very small amount of money regularly despite having a debt to pay, the power of computing will make that regular contribution a big amount. You may use that amount when your debt is over.

I suggest that we should pay off our debt as soon as possible but at the same time we should save regularly and make our safety net in the form of insurance.