In my last post Banks Too Gain from Repo Rate drop, I had written that

Price of government bonds increase with the drop in interest rates.

Have you wondered why price of government bonds or other debt funds increase with the drop in interest rate?

What are Bonds?

Bond in its simple term is giving a loan to an entity with pre-determined interest rate for a specified duration. For example, recently closed IRFC bond, was for 10 year and 15 year duration with the interest paid on at 7.68% and 7.84% per annum respectively to individual investors. This means that if an individual investor invests Rs 10,000 in this bond for 10 years then he will get Rs 10,000 plus all the interest accrued for 10 years.

How does a person earn from bonds?

- A person earns from bonds by the interest accrued at the end of bond term. For IRFC bond an investment of Rs 10,000 for 15 years would have amounted to Rs 31,024 (use compound interest formula)

- The investor may sell his bond in secondary market at the prevailing market price which may be less than, equal to or greater than Rs 10,000.

Why price of bonds vary inversely to interest rate?

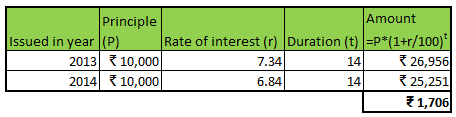

Price of bonds varies in secondary market (point 2 above). Taking our earlier example of IRFC bonds, rate of interest is 7.84% for year 2013. With the government planning to inject more money in the market, interest rates are expected to drop further. Let’s assume that rate of interest on IRFC bonds issued next year (year 2014) is 1% lower i.e. at 6.84%.

If an investor has brought IRFC bond in year 2013 decides to sell his bond an year later in secondary market, then the buyer will get 7.34% (rate of interest is 0.5% lower after re-sell so interest is 7.84-0.5 = 7.34%) yield after 14 years. The amount investor will get after 14 years will be Rs 26,956. However, if the same buyer buys IRFC bond issued in year 2014 then he would have gotten interest of 6.84% after 15 years. If we match the maturity dates and assume investor getting 6.84% in 14 years then he would have gotten Rs 25,250. The investor will earn Rs 1,706 more by buying the bonds issued in year 2013 rather than buying the same bonds issued in year 2014. So, the price of bond issued in year 2013 may command a premium of up to Rs 1,706 (there would be other factors at play so this number is just for illustration).

On the same lines, if interest rate rises then price of bond in secondary market comes down because buying the new bonds will fetch more rate of return.

References: