You want to go for vacations, buy a big house (or may be Farmhouse), fund your child’s education, start your venture, have regular income/increment, and plan for your retirement. But How?

- List, plan and work towards achieving your financial goals. Take help from professional and unbiased Financial Planners to help you plan.

- Make a habit of Invest First and Spend Later.

- Keep contingency reserve of at least 6 months of your salary to support your family in case of any turmoil. This money can be kept in a liquid asset, saving/fixed deposit, gold etc. This money should not be in real estate.

- Buy a term policy for the earning members of your family. This policy will give you peace of mind and may give some comfort at the time of big loss. This is especially important for single bread-earner in the family.

- Buy a medical insurance that covers most of the hospitalization and some of the expected/unexpected medical expenses for the whole family. It may be necessary to buy an independent medical insurance even if your job provides one.

- Don’t rush into buying a costly house. Buying a costly house that drains all your salary to pay EMI would reduce your capacity to have sufficient money to fund other necessary investments/expenditures. If you are too keen to have a security of own house then start with a smaller one.

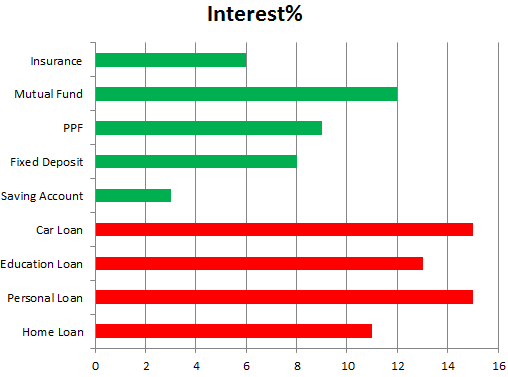

- Keep your investments diversified. However, take care that diversification should be within your level of control. If it is too diversified that you are not able to attend at least once in 6 months then you are overtly diversified.

- Look for alternative source of money – start your venture, invest or do part-time job.

- Keep yourself and your family happy and healthy.

In sum, one should have his turf fully covered and then leap on to make/save/invest money to pursue one’s dreams.

Pingback: Outsourcing Pilgrimage | FinHow

Pingback: Surplus – Home Loan Prepay, Home Saver Loan or Systematic Withdrawl Plan » FinHow