We need to maximize income and minimize expenses to lead a happy financial life. With 40-50% of a household cost going for home payment and another 20-30% going for conveyance, it is very difficult to manage expenses, however, we can still save some.

You can save on

- Home expenses – 40-50% of a middle-class household’s income goes for maintaining the “makaan” (house) portion of “roti, kapda aur makaan” (bread, cloth and house). A family may spend on rent or EMI to own the house, expense generally stands the same.

- If you own a home and paying EMI then

- look for the bank that gives lower rate of interest.

- You may also opt for “Home Saver Loan” to make your contingency money save interest outgo for you.

- When buying a home, consider buying your home with friends. When buying multiple units, builder may give a better deal.

- If you rent a home then look out for options to minimize the rent. Some of the ways you can adopt is

- Request your company to help you get company lease. Company lease is cheaper than renting individually.

- Rethink whether you really need such a big house or in such colony.

- Conveyance – Conveyance in the form of regular commute and EMI/depreciation of car consumes 20-30% of the household income.

- When buying a car

- Choose the car that best meets your demand and not just by hearsay.

- Look for group buying with your friends. You all may get a bigger discount than any individual would get.

- Choose universal colors such as silver, white or black for your car. These color cars can be cheaper to buy and cheaper to maintain if at all you need to get a nick repaired.

- Check if your company has a corporate agreement with any car maker. Many a times, you may get discounts at the car dealership just because you are an employee for a corporation.

- You may opt for used/second-hand car.

- If you commute by public transport then look for bulk buying of tickets such as opting for monthly pass

- If you commute by own car then

- look for car-pooling.

- Maintain your car well so that you can get maximum mileage on your car

- Remove unnecessary items from your car. Those items can be your cricket kit that you need over the weekend or your child’s car seat which too is rarely used.

- If possible, take a day off or work from home sometimes. You will get a rest and your family can get more of your time.

- Grocery – Grocery accounts for 5-10% of a household income. Since this head is too small, you may not save much on this account.

- Look for a bigger and discount stores. These stores buy items on large scale so pass on the benefits to customers.

- If an item is non-perishable and it is regularly required, you may opt for a bigger pack. Bigger packs are generally cheaper per unit quantity than a smaller packing.

- Keep an eye on the discount pamplets that come with the newspaper.

- Do not buy an item just because it is on sale unless you would have bought it without discount and you really need it.

- Entertainment and Shopping – Entertainment generally ranges from 1-10% of a household income. Here too you can save.

- Do not buy an item just because it is on sale unless you would have bought it without discount and you really need it.

- Keep in touch with friends on the offers on the items that you need to purchase or on entertainment avenues such as movie.

- Online deals and coupons sometimes look nasty but they can help a save. Recently, I saved 25% on a restaurant bill and 40% on Dan Brown’s Inferno.

- Limit your dining outs and prefer to eat at home. This cuts down unnecessary expenses and keeps you healthy.

- When going on vacation, look for vacation packages.

- Look for store cards/corporate discount by your employer.

- Avoid buying anything on installments/EMI except house. Buying a house through home loan (EMI) is a good idea for mainly two reasons – 1) there is not enough money to buy a home in one go, 2) when you buy by loan, banks do a due diligence to ensure that property you are buying is legitimate.

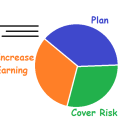

You should not save on

You should reduce your expenses but that does not mean that you drop these expenses altogether. Nonetheless they are very important for your financial future.

- Not buy sufficient Life and Medical Insurance

- Not spend appropriately to maintain your social circle.

- Not spend on the entertainment of self and your family

- Not spend appropriately for well being you and your family – roti, kapda aur makaan. This includes safety of family and your property.

- Not invest to maintain future income

This article aims at reducing unnecessary expenses and not to cut down necessary expenses. Remember that there is always a limit to saving so be prudent when saving. Instead focus more on investing.