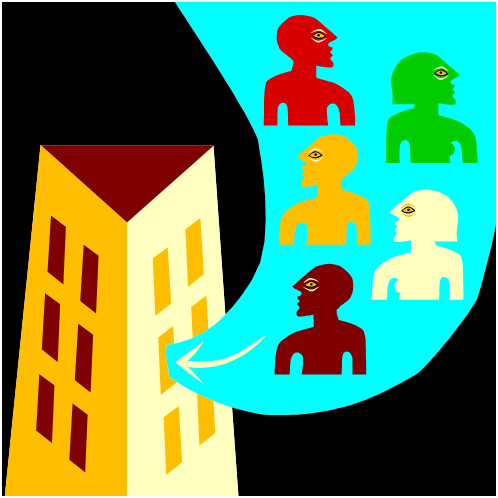

In order to bolster investor confidence and reduce the loopholes in buyback of preferential shares, SEBI plans to bring in more rules.

1. A company declares buyback which causes increase in the share price and the promoter buys back those shares through frontline companies

- The company will need to declare the number of shares bought back and the amount utilized on a daily basis.

- The company will need to declare the source of funds upfront.

- The company will need to destroy the buyback shares by 15th day of the next month while buyback is in progress, and to destroy the shares by 8th day of the next month after completion of buyback period.

2. A company declares buyback only to increase share price irrespective of sufficient availability of funds to buyback

Company will need to deposit 25% of the proposed buyback cost in an escrow account. Here another loophole is that proposed buyback cost can be deflated.

3. A company declares buyback but does not buyback enough to make big benefit to investors

- The company will need to buyback at least 50% of the declared amount (number of shares) when buying through Open Market.

- When shares are bought by tender offer then the minimum limit of buyback is 15%. This will give maximum benefit to investors.

4. A company takes too long to buyback which doesn’t give much benefit to investors

The entire buyback has to be completed within 6 month instead of currently 1 year limit.

5. A Company may not meet the criteria set forth and may just pay meager fine to SEBI

The company will be barred from making any other Buyback option in next 1 year if it doesn’t fulfill the norms.