Hindustan Unilever Limited announced an open offer of its shares at a price of Rs 600 + final dividend of Rs 6 for those who opt for this open offer. This M&A transaction will increase the promoter Unilever’s holding in Hindustan Unilever Limited from 52.5% to 75%. Should you as an investor opt for this open offer?

- HUL’s share price has been hovering in the range of Rs 590 since Apr 30, 2013. If we add final dividend into the offer price then final price offer price becomes Rs 606. This is meager 2.7% profit.

- Shares surrendered in open offer will attract capital gains tax and these taxes will make the open offer not lucrative. This tax will be 10% without indexation and 20% with indexation. Let’s take an example.

- An investor purchased HUL shares on 22-Jun-2010 at closing price of Rs 262.

- If he sells at Offer price of Rs 600 + Rs 6 final dividend.

- He will make (606-262) = Rs 344 in net profit or 131% profit.

- He pays capital gains tax at 10%, then net tax = Rs 34.4

- Profit after deducting tax = Rs 309.60

- Net Profit% = 118%

- If he sells in open market at Rs 590

- He will make (590-262) = Rs 328 in net profit or 125% profit

- Security Transaction Tax at 0.1% = Rs 5.9

- Profit after deducting tax = Rs 322.10

- Net profit% = 122.9%

- Thus, net profit made by selling HUL shares in open market is 5% more by surrendering in Open Offer.

- HUL owns brands that have a very loyal fan-following – Lux, Lifebuoy, Surf Excel, Rin, Wheel, Sunsilk, Pepsodent, Closeup, Axe, Brooke Bond, Bru, Knorr, Kissan, Kwality Wall’s and Pureit

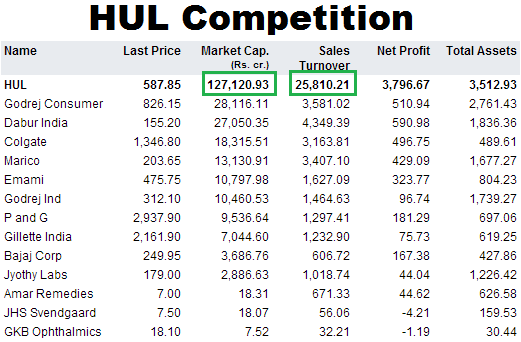

- HUL is way ahead of its competitors in market capitalization and sales turnover. Other statistics of HUL are also encouraging in comparison to its competitors.

- When parent company increases its holding on a company then there is a good chance that parent company looks at the company as a profitable venture. In that case, an individual investor may stick to the decision of parent company of holding the shares.

In sum, it may be wise to hold HUL shares if possible or sell in open market instead of opting for Open Offer.

Pingback: Finhow – After 50 Posts » FinHow

Pingback: HUL Buyback Recommendation Worked, What Next? » FinHow

Pingback: 5 Ways Companies Pay its Shareholders » FinHow