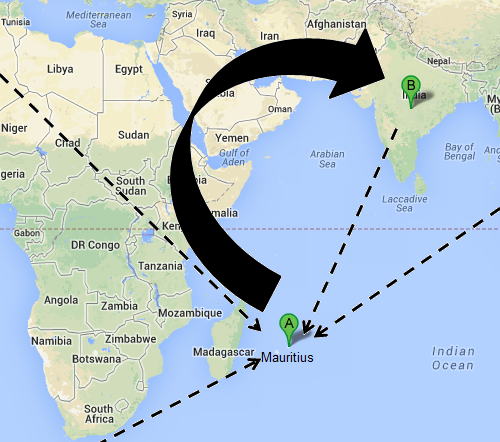

40% of India’s Foreign Direct Investment (FDI) comes from Mauritius and financial services sector contributes 80% to Mauritius GDP. India has a Double Taxation Avoidance Treaty with Mauritius and it is believed that the treaty is misused by some to save tax.

What does the treaty say?

According to the DTAA treaty signed in 1982, any FDI coming from Mauritius, will incur capital gains tax only in Mauritius and not in India. Mauritius does not charge capital gains tax so the investment becomes tax free in the hands of a Mauritian.

A company must be a Global Business License Company under Financial Services Commission (FSC) of Mauritius entity to undertake global business activity (e.g. International trading, investment holding, offshore insurance, offshore funds management, IT services etc.) and must satisfy the following conditions to avail DTAA benefit (Reference Strafinglobal website):

- The Company is centrally controlled and managed in Mauritius

- Two resident Directors on the Board

- The Company has a qualified resident company Secretary

- The registered office and business address of the Company is in Mauritius

- The Company must maintain an account with a local bank through which funds must flow

- All Meetings of the Board of directors are held in and chaired from its Registered Office in Mauritius

- The Company records are kept at the Registered Office in Mauritius

- The Company’s administrator is based in Mauritius

- The auditors of the Company are based in Mauritius

If a company satisfies above conditions then FSC grants Tax Residency Certificate (TRC) and that certificate needs to be renewed every year to avail DTAA benefit.

Why is it perceived that treaty is misused?

- Statistics that 40% of India’s FDI comes through Mauritius makes it suspicious that all investments coming from Mauritius may not be genuine

- Money earned in India may be routed through Mauritius to save tax. This is called round tripping. With unaccounted money (black money) almost running a parallel economy in India, possibility of round tripping is very high.

- Mauritius route may be used for money laundering for fraud, criminal and terror funding purposes.

- Investors may use Mauritius’s company as a shell company just to save taxes on investment in India.

- There is a requirement of only one shareholder for Mauritius Company. With minimum number of shareholders of a company, possibility of making a shell company only for tax haven is easier.

What are the steps taken to prevent misuse?

- Requirement for control of company in Mauritius by resident directors, secretary, office, bank accounts and board meetings in Mauritius is in the spirit that company is truly a Mauritius company.

- TRC can be issued only after auditors certify that round tripping of funds has not been done.

- SEBI and FSC have signed a Memorandum of Understanding (MoU) introducing Mutual Assistance in Criminal and Related Matters Act of Mauritius.

- Mauritius has agreed to station an officer from Indian Revenue Department for better exchange of information and regulation of TRC.

- There is a discussion (quoted ‘agreed on’) on a new Tax Information Exchange Agreement (TIEA) between India and Mauritius.

- While filing for TRC, a Mauritius company needs to declare that it cannot invest funds derived from India back to India unless it has permission from RBI. This will make round tripping of funds an explicitly committed offence.

- There is also a possibility to modify DTAA with Mauritius in line with India-Singapore tax treaty (minimum investment of $200,000 and track record of two years).

Reference

- Mauritius has gone ‘extra mile’ for India tax treaty: Minister

- Mauritius plans to plug tax treaty loopholes, may make listing of cos essential to invest in India