National Spot Exchange Limited (NSEL) was in news recently for SEBI barred trading in NSEL and the talk about payment default loomed over NSEL.

What is NSEL?

National Spot Exchange Limited (NSEL) was incorporated as a company in year 2005 and started trading of commodities in year 2008. Financial Technologies Limited is the promoter of NSEL.

NSEL acts as an intermediary between buyer and seller for commodities such as Agricultural products (Wheat, Rice, Cotton, Chilli, Pulses etc), bullion (gold, silver, platinum), metals (steel, copper), coal. It provides all the facilities that a buyer needs (finance, warehousing, medium to link with seller, assurance of quantity and quality) and the facilities that seller needs (medium to link with buyer, guarantee of payment). It also deals with e-commodities such as e-gold, e-silver, e-platinum etc.

What Happened and Why It Happened?

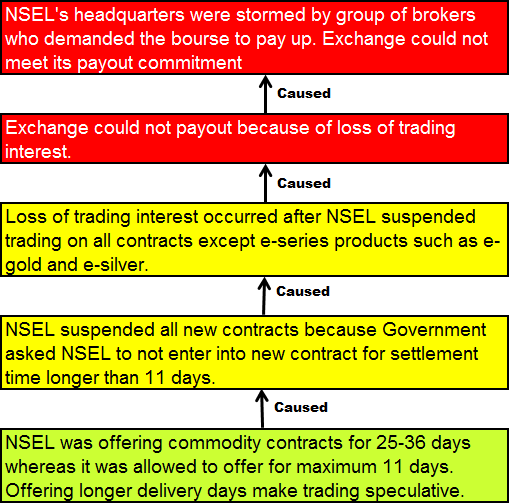

As per new contracts in NSEL, one could buy receipts on 1-day settlement basis and sell them on 25-36 day settlement basis at a higher price. Speculative trading is not allowed to NSEL and loss in speculative trading could lead to crisis in equity, currency and derivative market.

NSEL stated that it has open position of Rs 5500 crore while it has commodity to the tune of Rs 6200 crore. However, there is a suspicion on quality and quantity of collateral commodity of Rs 6200 crore. As per the news, until the suspension of trading, NSEL was making regular payments and all books looked to be in order.

How You may be Affected?

- If you are an investor (directly, through mutual funds or other investment instruments) in parent company of NSEL, Financial Technologies Limited (FINTECH) then the value of your investment may have fallen. FINTECH shares were trading at around Rs 550 until July 31 and now they are trading in the range of Rs 191. Another associate company MCX too suffered losses on bourse.

- Your business or job may be affected if you are part of NSEL, FINTECH, MCX.

- If NSEL is not able to settle all its Rs 5500 payout requirement then

- Retail and institutional players may liquidate some of their position in equity, derivative or currency market to payout for NSEL’s losses (if it occurs).

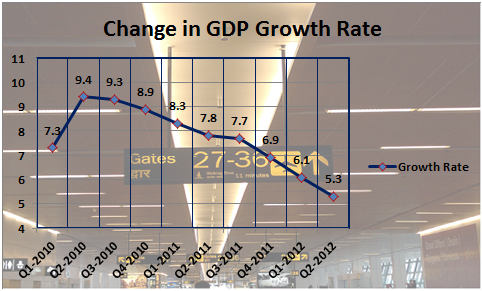

- Foreign investors may start losing confidence on regulatory in India. This may lead to foreign investors pulling their investments out of India, which India badly needs to funds its current account deficit.

Reference

- Sebi seeks details from brokers about exposure to NSEL

- NSEL crisis: 10 reasons why Financial Tech crashed 80 percent in 2 days