On July 16, 2013 Reserve Bank of India (RBI) raised Marginal Standing Facility (MSF) by 200 basis points (1 basis point is 0.01 percent) to make debt securities more attractive for foreign investors and the result is that home/car loans may get costlier. MSF is just one tool in the arsenal of RBI to control liquidity in economy. Let’s see what other tools (excluding Open market operations) RBI can use to control inflation/growth of economy.

1. Cash Reserve Ratio (CRR) [Current value – 4%]

It is the minimum percentage of deposited amount with a commercial bank that the bank must retain in its vault or deposit with Central Bank. This amount may not be given away in the form of loan or other instruments as part of banking business. Central bank may use this tool to control liquidity in economy.

Pros and Cons of using CRR to control inflation/growth

Pros

- This factor can bring quick changes to economy. For example if inflation is getting too high then raising this ratio will suck considerable liquidity from economy overnight and inflation will be controlled (if people have less money, one can buy at lower price and sellers will have to sell at lower price).

Cons

- When this number is raised, small banks may suddenly find themselves non-compliant and borrowing money to maintain this ratio may eliminate business viability of these banks.

- There is a limit to raising and reducing this ratio.

- If it is raised too much then banking business may become unviable to some banks (as in above point)

- if it is reduced too much then it would be very risky in case of economic turmoil and bank may not be able to pay back depositor’s money. Anyway, it cannot be reduced below zero.

2. Repo Rate [Current Value – 7.25%]

Repo rate is the rate at which Central Bank lends money to commercial banks against securities (just like mortgage) when commercial banks get short of funds. The higher this rate, banks will get costlier capital and banks will, thus, charge higher rate. Just like Repo Rate there is Reverse Repo Rate, but Reverse Repo Rate is not used to control inflation/growth so I will just give the definition here.

Reverse Repo Rate [Current Value – 6.25%]

It is the rate of interest at which Central Bank borrows money from commercial banks. It is kept at 100 basis point or 1% lower than Repo rate. Banks generally use this instrument to park their excess fund in safe hands and still earn some interest. Central banks do not actively use this tool to control economy.

Pros and Cons of using repo rate to control inflation/growth

Pros

- This tool is a quick fix for woes of economy and brings in results very fast. The higher the number goes, less money is available in economy and inflation goes down. The lower this number and more money will be available in country to enable it to go on growth path.

Cons

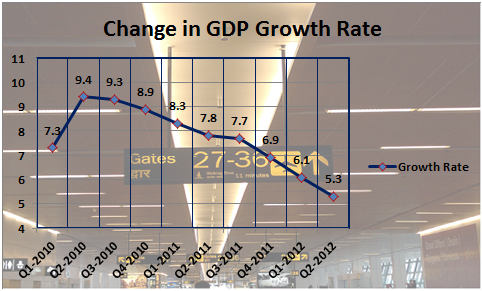

- The change in this number affects both growth rate and inflation of economy. If this number is raised, inflation reduces, and growth also reduces. So this tool should be used with extreme caution.

3. Bank Rate [Current Value – 10.25%]

Bank rate is similar to repo rate except that commercial banks need not give any security when borrowing from Central Bank. Since, loan without security (no collateral) is risky, Bank Rate is higher than Repo Rate.

Pros and Cons of using Bank Rate to control inflation/growth

Pros

- This tool is a quick fix for woes of economy and brings in results very fast. The higher the number goes, less money is available in economy and inflation goes down.

- Bank rate is the fastest method to change inflation/growth (liquidity) of economy. Any change in this rate almost always causes change in rate of interest of savings/fixed accounts as well as of car, home loans etc.

Cons

- The change in this number affects both growth rate and inflation of economy. If this number is raised, inflation reduces, and growth also reduces. So this tool should be used with extreme caution.

4. Marginal Standing Facility (MSF) [Current Value – 10.25%]

Marginal Standing Facility is the mechanism by which banks may borrow money from RBI. This facility is for emergency funding of banks. Banks may borrow up to 1% of their net demand and time liabilities. The rate of interest on this borrowing has been increased by 2% on July 16. If you notice, this rate is higher than home loan rate of interest 9.95% offered by SBI (value is at the time of writing this post). If bank gets capital costlier then they may increase rate of interest.

Pros and Cons of using MSF to control inflation/growth

Pros

- This tool is for fine tuning of economy because loan in this arrangement is very costly, used only in case of emergency and has a limit on the amount that can be granted.

Cons

- This tool does not bring big impact to economy and may take long time for its effects to be seen. On July 16, RBI needed to increase this value by 200 basis point to make significant changes (200 basis point is a large number for all the tools in this point).

5. Statutory Liquidity Ratio (SLR) [Current Value – 23%]

It is the fraction of amount of demand and time liabilities that bank has to keep in cash, gold or government approved securities. Since all customers may not come to redeem their Fixed deposits in one go, all creditors will not encash Letter of Credit in one go and all overdraft would not be demanded in one go, banks are allowed for less than 100% of the amount bank may need to pay. SLR is not revised often and it stays around 23-24% value most of the time.

Pros and Cons of revising SLR to control inflation or growth

Pros

- Central bank can control credit in circulation using SLR. If chances of default is large then government may increase SLR to reduce default and increase confidence of investors.

Cons

- SLR cannot be reduced too much because that reduces credibility of commercial bank, central bank and for the whole country.

Reference

Demand and time liability in simple terms is the money that bank may need to give away at a current time. Read Define Demand and Time Liability for more details.

Pingback: What is Quantitative Easing? » FinHow

i am happy to read above five tools which has used to control inflation thank you