Short term outlook for Indian economy is not bright. Sensex has lost around 4% in last 6 months, growth forecast has fallen to 5%, rating agencies are threatening to downgrade India’s rating, populist measures are rampant and subsidies are getting higher with general election around the corner. In times like these when most of the parameters look negative, one should follow a strict regime.

Job

- In such times, corporations may be under financial pressure to cut costs and thus jobs may get scarce. It may be prudent to stick with the current job. One should switch only if the new employer is far better than last one.

- Do not give a chance to your employer to chop-off your position. Help your employer deliver the goods and services, and make money so that he too may pay you.

- Learn new skills or enhance your skills. Many a times, employers reimburse employees who undertake trainings or certificate. Such skill enhancement can come handy to your employer (and yourself too) when market bounces back.

- Look for second income to supplement in case of loss of job or reduction in salary.

Business

- Pull back discretionary expenses. Expansion of office space, decoration or sending costly gifts to customers may be controlled.

- Look for expansion of customer base. This move may cushion if a few of your customers faces the heat.

- Understand the real needs of customer and try to address those needs. In win-win situation, the needs of two parties may not be conflicting and other party may need something that is not of high value to you and similarly other person may give something of high value to you for a bargain.

- Look for cost cutting opportunities. However, ensure that cost cutting does not harm employee morale because happy employees can make happy customers.

- Reduce bench by engaging most of the employees in some activity. If no such activity can be undertaken then employees can undertake training and skill enhancement.

- Try not to cut on training. However, reduction of cost in training may still be carried out as long as quality of training is not reduced considerably.

Non-Business Expenses

- Cut down discretionary expenses such as eating out, movies and vacations. Instead, one may have good time at home. Meeting friends at homes may be cheaper and fun filled.

- With festival season in sight, one may look for bargains on the necessary items (only) for festivals now. The last minute price may be more so keeping a watch may get the items cheaper now.

- Postpone buying high ticket household items such as home appliances unless they are a must.

- Avoid foreign travel because weak rupee will cause more spending.

- If an expense is imminent then one may look for bargain price now.

Investment

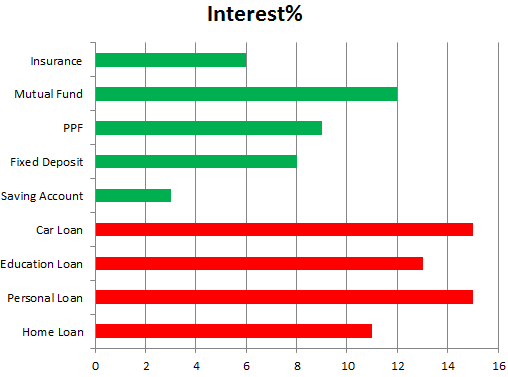

Equity

- Do not pull out money from investment in haste. Review your financial goals, consult a financial advisor and perform due diligence before withdrawing or investing in new financial products.

- If you are holding large cap equity then it may generally be wise to hold on to your investment.

- If you are holding mid cap or small cap (penny stocks too) then it may be wise to consider investing in large cap equity.

- Do not indulge in intra-day trading. Market can be very choppy at this time.

Mutual Funds

- As a general advice, continue to hold mutual funds at this time. However, since mutual funds would differ, perform due diligence on the fund that you are holding.

- Do not stop SIP at this time.

- Start a SIP that has generally given good returns in the past. With valuations low, you may get more units than when market is high.

FD, PPO and such safe instruments

- Continue to hold your investments.

- With interest rates getting higher, you may consider fixing higher interest rates now.

Safety net (insurance, contingency fund etc)

- Continue to pay insurance premium. You should have enough cover in term insurance, personal accident insurance, medical insurance, serious illness insurance cover and householders insurance.

- Do not withdraw from contingency fund at the first sign of distress. Instead cut down on expenses.

Loan

- Continue to pay high interest loans such as credit card payments. These payments are always among the top priority for any financial planning.

- Do not attempt to pay your loan quickly by paying more from any surplus money you get without first ensuring that you have enough contingency fund (cash, FD or in liquid funds) for around 6 months.

- Postpone taking loans at this time because interest rate is high and it is likely to come down. Moreover, one should be watchful of spending money at this time.