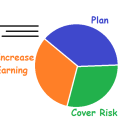

Only when perils, such as flooding in Uttarakhand, strike, people look for a shield to save themselves from overwhelming financial damage. Householders Insurance is the savior that can save a family from such calamities. The policy can cover the structure of house as well as the contents in the house. So, irrespective of whether a person is home owner or anyone living in the house (tenant), the resident may take benefit of this policy.

[youtube http://www.youtube.com/watch?v=qQCGrGuejqM]

Insurance company would deduct depreciation and consider all the clauses of a policy before paying any claim. Just as with any insurance claim, the insured must have paid the insurance premium before filing any claim and the insured must let the insurance company survey the damage before making any repairs.

Home Structure Insurance

As the name implies, this insurance covers any damage that may occur to the structure of the house. The claim may be filed for expenses on

- Removing debris

- Obtaining sanctions to rebuild house

- Architect fees

- Construction of house including the foundation

Home Contents Insurance

Home Contents Insurance covers damage to the contents of the house. The contents may be placed in the house at the time of claim or may be in use by the insured or insured’s family. For example chain snatching of insured’s family may be covered under this policy. The claim may be filed for the expenses on

- Household goods and personal effects

- Domestic appliances

- Jewelry and values kept in bank locker

- Plate glass or window panes in home

- Loss caused by insured or insured’s family to others’ property

- Injury to any person employed for work at home

Risks covered (generally)

- Fire

- Lighting

- Explosion/implosion of household appliances

- Burglary, theft and other such attempts

- Earthquake, flood

- Riot, strike, vandalism and terrorist attack

- Landslide

- Bursting or overflow of water tank, pipes or fittings

- Storm and other high wind conditions

- Damage caused by aircraft

- Impact damage

Risks not covered (generally)

- War and war like condition (notice that terrorist attack is generally covered)

- Nuclear radiations and related perils

- Willful act or negligence of insured

Conclusion

Many a times, we could pay pennies earlier rather than lose all our belongings and spend our lifetime savings to rebuild it. House Holders policy is “paying those pennies”. Learn more about it and decide whether you need this policy. Until then, stay safe and be prosperous.