HUDCO has come up with Tax Free Bonds that will generate capital of Rs 750 crore with an over-subscription option of up to Rs 4809.20 crore. This issue has a number of advantages for which an investor should give a serious thought in investing in this issue.

- This issue is secured, redeemable and non-convertible debenture. By secured, company will always retain a collateral to pay back the loan that it takes from subscribers.

- There is an option to stay invested for 10, 15 and 20 years. With the interest rates at the highest level, one may lock in the high interest rates for a long time.

- The issue carries ‘CARE AA+’ and ‘IND AA+’ from CARE and India Ratings and Research Private Limited (formerly Fitch Ratings India Private. Limited) (“IRRPL”) respectively. As per the definition of AA

Instruments with this rating are considered to have high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk.

- HUDCO is Government of India undertaking and thus carries the backing of government of India.

- The bond is tax free, which means that the return on these bonds will not be taxed. However, the money earned to invest in this bond may incur income tax depending on one’s income and source of income. Capital gain on bonds proceed may be eligible for indexation, which may reduce tax liability to none.

How much one can invest?

Face value of each bond is Rs 1000 and an investor needs to buy minimum 5 bonds i.e. minimum investment of Rs 1000. Thereafter, one may invest in multiple of 1 bond. i.e. one may buy 6 bonds. Interest will be payable annually.

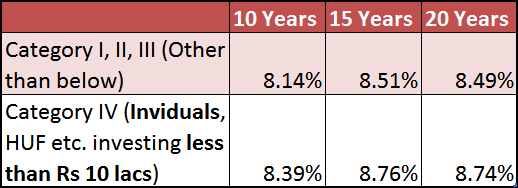

What is ROI (Return on investment)?

Who may subscribe?

There are four category of subscribers. Category I is generally large financial institutions, category II are companies, category III are High Networth Individuals investing more than Rs 10 lacs and category IV are retail investors investing up to Rs 10 lacs.

How to subscribe?

The issue opened on September 17 and will close on October 14, 2013. The bonds will be listed on the BSE (not on NSE). One may apply for bonds in demat form (refer to your demat portal) or in material form. Refer to link HUDCO Tax Free Bonds link at HUDCO website