Will is something that sends shrills when anyone discusses in family. However, Will is most sought when there is a dispute over ancestral property. When a close one dies without a Will, some wish that their dear had written a Will. Some fear and wish that there is no Will because the person would not have done them a favor.

Benefits of preparing a Will

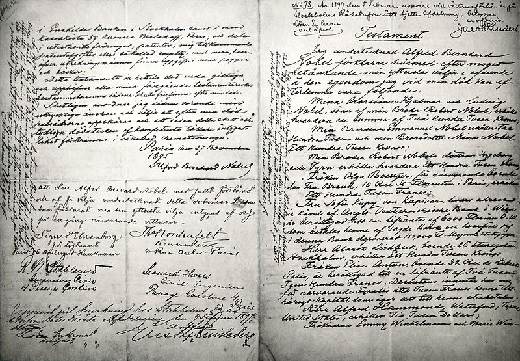

Will is a document that a person prepares to distribute all his wealth in the way he wishes to distribute. Its benefits surpass all benefits of not making a will at all.

- One may distribute one’s wealth as per one’s wishes. In the absence of a Will, a person’s wealth can be distributed by Hindu Succession Act or other Acts as per one’s religion.

- In the absence of a Will, family members will need to provide probation that they are the sole claimant of the wealth. The probation takes at least a couple of months and family may undergo financial hardship even if the person’s bank account has available money to withdraw.

- Family may face hardship because of far relatives claiming share of wealth.

- A Will can prevent feud in the family over property or wealth dispute.

Will has majorly three sections

- Declaration that the person is writing with his free will and he is sane

- Declaration of accumulated wealth

- Distribution of wealth to individuals/corporates/charities. Distribution also includes Executor and Trustee who will execute the Will after the death of person.

After these three sections, Will should be signed by the person and two witnesses.

After preparing a Will

- One should make a copy of Will and retain a copy with oneself and store original in preferably a bank locker. There should be only limited number of copies of Will (preferably retain 2 copies only).

- Always seal the original Will in an envelope with signature of the preparer.

- Get your Will registered if possible.

- Inform your near and dear ones that there exists a Will.

Precautions while preparing a Will

- A Will should be made on a good quality paper and preferably in assistance with a lawyer.

- Declaration should clearly state that the current Will be the only effective Will and override all Wills prepare to the current.

- Declaration should mention information so that sanity of the person who is preparing the Will can be established.

- Declaration of accumulated wealth may not include inherited wealth and can only be the wealth that the person earned. However, the person may declare one’s share of inherited wealth for distribution in wealth.

- While distributing wealth to different entities ensure that one’s immediate family has been financially taken care of. Otherwise Will can be challenged in court.

- Executor and Witness should not be beneficiaries in Will otherwise that situation would be construed as conflict of interest and can be challenged in court of law.

- Executor and Witness should be of good health, younger in age to the person writing the Will, have good moral character and can be located easily when the need comes. Will may also declare secondary Executor to execute Will if primary Executor is not around.

- People postpone the decision to prepare Will until around Retirement. However, Will is no different from an insurance policy. You or your family may need Will even before that time.

- Consider tax implications on the beneficiaries of Will

Conclusion

Do not postpone your decision to prepare a Will. One may prepare Will irrespective of being young or well over retirement. Preparing Will is easy and the benefits it gives are immense. One should prepare a Will just as an insurance policy.

Pingback: Hindu Succession Act 1956 » FinHow