I was hopeful that it is just the temporary phenomenon and NSEL would be able to settle Rs 5,500 crore dues for all the investors. The temporary phenomenon at NSEL was really a symptom of the systematic fraud.

What was the fraud?

- The contracts had to be backed by warehouse receipts that would serve as collateral for investment. Warehouse receipts were indeed issued for all the investments, however,

- Receipts were unreal and the actual goods were not present in warehouse, or

- Receipts were real and goods were actually present in warehouse, but a receipt issued to multiple investors simultaneously.

- The price of the commodity was manipulated by a consortium, which is the reason that NSEL trades were always profitable for investors.

- The money collected by borrowers in exchange for goods in warehouse (or so called warehouse receipts) was used for their own business, buying land parcels or possibly money laundering.

Why did it go so long?

- Broker (NSEL) turned blind eye towards the sinister moves because for every trade that occurred NSEL was earning huge brokerage.

- Not only brokerage, at least one of the beneficiaries (defaulters) of NSEL was relative of board members (Chairman’s son in law). So there seems to more gain than just brokerage.

- Government was not regulating NSEL under FMC because it had obtained waiver from Consumer Affairs Ministry from the Forward Contracts Regulation Act.

- Everyone was making a profit and no one bothered until their investment was at risk.

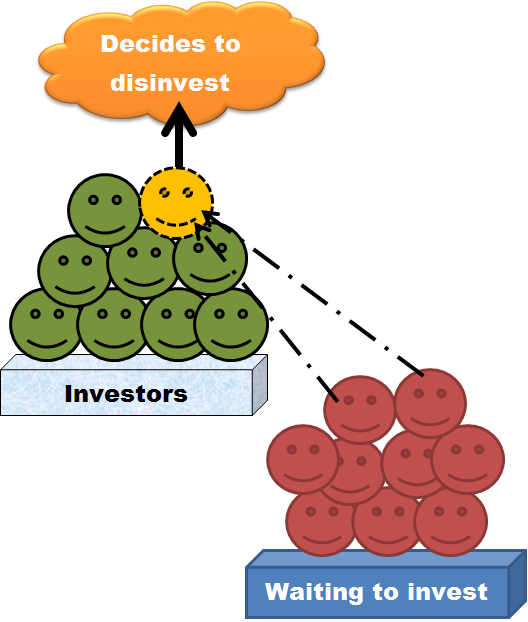

- Whenever any investor exited from an investment, his warehouse receipt could be sold to another investment. Since NSEL was giving huge profit, there was no dearth of investors waiting to join the dance. It was like a Ponzy Scheme.

Could it go forever?

It does not seem likely that this fraud could on forever because it was like a Ponzy Scheme and Ponzy Scheme can go on until there is a scarcity of new investors. Scarcity of new investors occurred due to

- Bad word about the possibility of scheme going bust

- Government intervention to stop 30 day contract which NSEL was not allowed to carry out

Latest Development

- Anjani Shah, MD and CEO of NSEL, is in police custody

- Accounts of Jignesh Shah (CEO of FMSE, promoter of NSEL) and Joseph Massey (former NSEL Board Member) have been frozen.

- Some of the biggest defaulters are in talks with Economic Offences Wing to give time to settle their dues.

- Mohan India has paid Rs 11 crore and agreed to pay Rs 771 crore in monthly installments in 1 year.

- Managing Director Nilesh Patel of NK Proteins, defaulter of Rs 900 crore due to NSEL, has been arrested by EOW.

- EOW has questioned directors of P.D. Agro Processors Pvt Limited (owes Rs 639.55 crore to NSEL) and Lotus Refineries.

- Lotus Refineries that owes Rs 252 crore to NSEL, has given Rs 8 lakh to exchange. This is a drop in bucket but something is still better than nothing.

- The fire has even spread to another commodity exchange – MCX and MCX is looking for CEO and MD. Apply if you would like to take up this challenging position.

![MCX Advertisement for Vacancy of MD and CEO [Picture clicked from Economic Times on Oct 31, 2013]](https://www.finhow.com/wp-content/uploads/2013/10/MCX-Ad-for-Vacancy-of-MD-CEO.jpg)

MCX Advertisement for Vacancy of MD and CEO [Picture clicked from Economic Times on Oct 31, 2013]

Conclusion

NSEL crisis seems to be a Ponzi Scheme that promised to pay investors anywhere from 15% to 18%. Everyone was jumping at the prospect of making such profit without analyzing the risks and fraud behind such handsome returns. EOW is trying hard to recover those (over) smart investors’ money now.