Higher education and globalization are two key factors for the growth of prosperity of people and rise in awareness about financial products. Higher education and especially foreign education are too costly for a middle class youngster and the burden passes on to parents unless the youngster opts for Education Loan.

Terms of Education Loan

Education loan is given by almost all nationalized banks and many private banks. All banks have their loan products slightly different from one another however fundamentally they are the same.

- Education loan is granted for full-time course only. Most of the time, part-time courses are not covered in Education Loan. Admission offer in recognized courses from well reputed institutes in India and abroad is a must for grant of these loans.

- Parents (including in-laws), guardians or sometimes spouses need to be co-borrower in loans. No further collateral is required for loans up to a certain amount (~Rs 4 lac). However, beyond a certain amount (~Rs 7.5 lac), a tangible collateral needs to be provided for disbursement of loan.

- Similar to collateral, banks generally ask for margin money when disbursing loan beyond a certain limit (~Rs 4 lac).

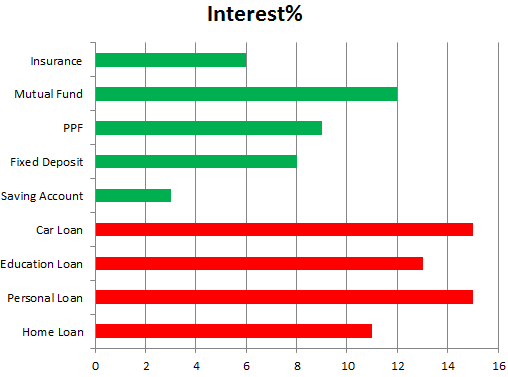

- Maximum limit of loan disbursed for studies in India is lower than maximum limit of loan disbursed for studies abroad. Better institute may command lower rate of interest owing to better employability of the borrower student.

- Loan covers tuition fees, study material costs, transportation costs for foreign travel and study trips. Some education loans also cover rent of accommodation by student and nominal conveyance charges such as two-wheeler. The components other than tuition fees have a maximum limit in percentage terms of tuition fees (eg. Not more than 10% tuition fees for transportation cost).

- The borrower needs to start paying EMI within 1 year of completing the course or within 6 months of getting employment post completion of course. There may be some relaxation to moratorium period and EMI may be skewed for courses where employment just after the course may not yield sufficient salary to borrower.

- Banks generally give better rate of interest (discount of ~1%) if borrower starts paying interest right from the start of disbursement of loan.

Benefits to Borrower or Parents/Guardians

- In the absence of Education Loan, the aspirant struggles to meet ends with education expenses and sometimes not even able to study, or the parents/guardians have to plan for education or dip in their retirement funds. Education Loan eases the financial burden at least until the end of course.

- The young borrower (student) gets a sense of responsibility because he is the one who needs to foot the EMI. The student works hard to finish his course within stipulated time with good grades and to get good employment.

- The young borrower holds on to his instinct of spending too much by his first salary when he has to first pay the EMI.

- Full interest (no limit) on Education loan is tax exempt under section 80E and that exemption is beyond Rs 1 lac limit under section 80C. However, the exemption needs to be claimed for maximum period of 8 years from the start of paying interest.

Conclusion

If you are looking for higher education then look for Education Loan to finance your studies. If you are parents/guardians of a young student who wants to undergo higher education then choose Education Loan instead of laying your hands on your retirement funds or any funds for that matter.