If you have a housing loan and recently received bonus or big sum of money as return from a previous investment then you may be thinking of reducing your housing loan EMI or at least the interest payout. You have three options:

- Pay the sum received to bank as Pre-Payment of Loan

- Convert your Regular Home Loan to Home Saver Loan

- Invest in Systematic Withdrawl Plan and pay your EMI from returns of SWP

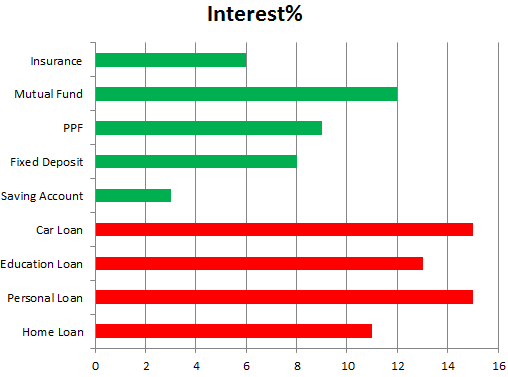

To understand the difference among the above options, we will take the example of a housing loan of Rs 20,00,000 taken at a rate of interest 10% and EMI paid is Rs 30,000. The loan will run for approximately 8 years and the net interest paid to bank will be approximately Rs 9.30 lacs.

1. Pay the sum received to bank as Pre-Payment of Loan

If you pre-pay Rs 5,00,000 at the start of the loan then tenure of the EMI may reduce to around 5 years and net interest paid to bank will be around Rs 4.5 lacs.

Pros

- Maximum reduction of interest paid to bank – around 50% reduction in our example.

- Very easy to execute, just pay the check of the amount to your bank

Cons

- The amount paid will not be available to you as your contingency reserve.

2. Convert your Regular Home Loan to Home Saver Loan

In Home Saver loan, a bank open a current account with your housing loan, increases interest on home loan by approximately 1% and any amount deposited in current account is reduced from principle due while calculating interest.

If we deposit Rs 5,00,000 to the linked current account and rate of interest becomes 11% then the effective tenure (tenure does not reduce upfront unless principle is actually paid) of the loan reduces to around 6 years and total interest payout becomes Rs 5.2 lacs.

Pros

- Money parked in linked current account can serve as contingency reserve.

- Substantial saving of interest paid to bank – around 45% reduction of interest in our example.

Cons

- No additional interest is earned on the money deposited in current account.

- Additional 1% interest on home loan.

3. Invest in Systematic Withdrawl Plan and pay your EMI from returns of SWP

If you invest Rs 5,00,000 in a System Withdrawl Plan that gives 12% rate of interest per annum and if you withdraw Rs 30,000 per month to pay for EMI then interest paid out to bank will remain Rs 9.30 lacs however interest received from SWP will be approximately Rs 50,000. Thus, net interest paid out will be 9.3 – 0.5 = Rs 8.8 lacs

Pros

- While SWP is giving returns, you can live EMI free. However, the return will last for a very short during – only around 1.5 years in our example.

- The principle amount deposited to SWP can be made available as contingency reserve.

Cons

- Minor reduction in net payout of loan – only 5% in our example.

Looking at the above options, it seems Home Saver Loan is the best option if you would like to reduce your interest outgo and still have money for contingency reserve.