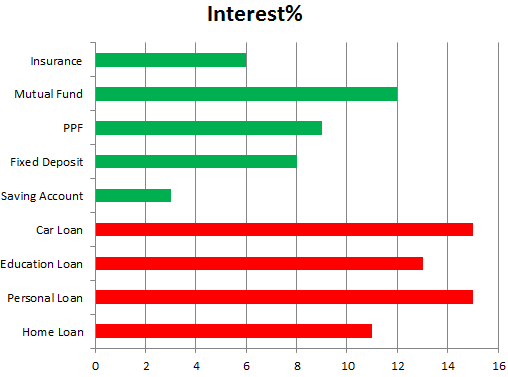

With inflation still high, it may be worthwhile to consider investments that beat inflation by high margin. Before we delve into options, let’s study what we get from FD.

What does an FD return?

Let’s take an example that a person invests Rs 10,000 in a nationalized bank’s Fixed Deposit. At present, the best rate of interest I found is 9% per annum compounded annually. Let’s say the person stayed invested for 1 years then at the end of 1 year he will get Rs 10,900.00.

Effect of Income Tax

Let’s assume that this person falls in the highest tax slab of 30%, so he will need to pay (900* 0.3) = Rs 270 as taxes. He is left with Rs 10,630 in total or a net gain of Rs 630. Thus, after tax, effective yield on his investment is 6.3% instead of promised 9%.

Let’s assume that this person falls in the highest tax slab of 30%, so he will need to pay (900* 0.3) = Rs 270 as taxes. He is left with Rs 10,630 in total or a net gain of Rs 630. Thus, after tax, effective yield on his investment is 6.3% instead of promised 9%.

Effect of Inflation

Fortunately, inflation for April 2013 has been report at 4.89% so we are beating the gain on our investment at 6.4%. The present value of Rs 10,630 today will be Rs 10,134. Thus, our net return on investment is Rs 134 on an amount of Rs 10,000 or a return of 1.34%.

Are You Happy With a Yield of 1.34%?

To stay ahead of erosion of your investment you may adopt a number of options:

- Company FDs – Some of the good FDs offer a rate of interest of 10% and it can go up to 14%, yield from these instruments will be a couple of times the yield from regular instruments. These FDs are not guaranteed as bank’s FDs but many of these FDs are backed by big and reputable corporate houses such as Mahindra and Mahindra. Some of these instruments are rated AA by Rating Agencies. (Reference Company Deposits)

- Tax Free Bonds – These bonds are mostly raised towards the closure of financial year and carry a rate of interest lower than regular Fixed Deposit, however, the interest earned is non-taxable. If we consider 1.5% lower rate of interest at 7.5% then net yield before considering inflation would be 7.5% instead of 6.3% in taxable Fixed Deposit. One of the popular tax free bond is from Indian Railway Finance Corporation Limited.

- Inflation Indexed Bonds – RBI is planning to introduce Inflation Indexed Bonds from June 4, 2013. The principle amount for calculation of interest on these bonds will vary according to inflation. Such instruments may safeguard against the risk that inflation imposes on investment.

- Mutual Funds especially SIP – Mutual Funds are composed of investments in varied investment portfolios from equity to debt, from gold to real estate, from petroleum to IT. The investment is managed by a team of experts on day to day basis. They may give lower yield then investing directly in equity but give much higher yield than Fixed Deposits.

Overall, keep your investment safe and yet make your money work for you.