I had recommended to not accept HUL’s buyback offer. The offer was under-accepted by 33%. Of the 48.70 crore shares offered for buy back, 32 crore shares were tendered. Of that 32 crore, Life Insurance Corporation (LIC) offloaded a substantial part. Overall, retail participation in this offer was quite low. Did you decline the offer?

After the buyback, let’s talk about the position one should take on this stock.

Buy (+)?

It may not be a good time to enter in this stock. It is expected that price of this script will correct, which may give an opportunity for a retail buyer to enter in this script.

Sell (-)?

The price of this script is at its all time high so it may be high time to book profit.

Hold (=)?

If you are holding this stock for long time wealth creation then you may retain it. It still holds good prospects in long terms

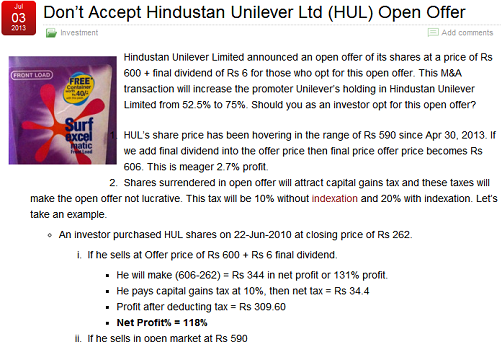

- It is market leader in the brands it owns. Refer to post Don’t Accept Hindustan Unilever Ltd (HUL) Open Offer for the brands HUL owns.

- It has the largest market capitalization and sales as compared to its competitors

- Its promoters believe that it will be a good wealth generator. This is the reason Unilever offered to buyback shares from general public.

Overall, the script seems most fit to hold.