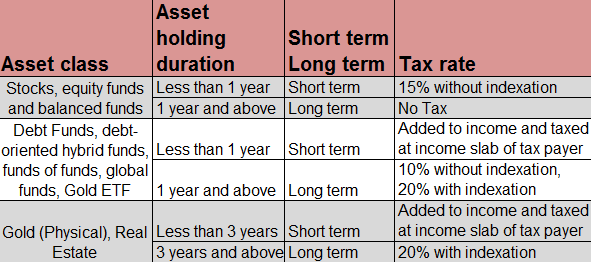

If you have recently sold shares, debentures, bonds, property, gold etc. then you may be subject to capital gain taxes. These taxes vary on the classification of asset sold, duration for which asset was held and whether capital gains arising out of the sale were reinvested.

How to save tax?

- As you might have seen that duration of investment makes a big impact on the tax that will be charged, it may make sense to review above illustration before quitting from any investment. You may further look that Government encourages investment in equity (least tax and investment for shortest duration) and discourages investment in gold in any form.

- Invest the capital gains to buy another residential property. There are two sections under which this investment can be made – Section 54 (Sell a residential property to buy another residential property) and Section 54F (Sell any asset to buy a residential property)

- A person may have invested 1 year prior to sale of asset and 2 year after the sale of asset to buy another house/flat.

- A person has 3 years to construct a house

- A person needs to deposit the sale proceeds of previous asset in Capital Gains Account Scheme account in one of banks. There are two options for deposit – Option A which is similar to Savings Bank and Option B which is similar to Term Deposit.

- Stay invested in the new house for minimum 3 years otherwise the capital gains on earlier asset sold will become taxable. The new asset that will be sold will qualify for the same tax rules as any other asset.

- Invest the capital gains to buy specific bonds usually issued by REC and NHAI. The rate of interest on these bonds is in the range of 6%, lock-in period is 3 years and interest earned on these bonds is also taxable. Loan or advance on these bonds will also be considered as cashing on the capital gains and attract Capital Gains tax.

Pingback: How to Adjust Losses Against Gains to Save Income Tax? » FinHow

Pingback: Invest in Fixed Maturity Plans (FMP) Now » FinHow