National Hydroelectric Power Corporation (NHPC) is going to launch Tax Free, secured, redeemable, non-convertible Bonds on coming Friday and these are an attractive investment instrument. Two of the prime reason for their attractiveness is that NHPC is Govt of India Company and the bonds carry AAA rating. The issues opens on Friday Oct 18, 2013 and closes at 5:00 PM on Nov 11, 2013.

About NHPC

National Hydroelectric Power Corporation (NHPC) is, as the name suggests, a company that deals with all aspects of setting up and operation of Hydroelectric Power Plant. It has completed 17 projects since its incorporation in Nov 1975. Most of its projects are in North and North Eastern States of India. NHPC signs Power Purchase Agreement (PPA) with State Governments, State Electricity Board through Government of India. These PPAs ensure that the power generated by NHPC is sold to earn revenue and profit.

NHPC is a Govt of India Miniratna Category – I Company i.e. this company has considerable strategic and operational autonomy and enhanced financial powers to set up joint ventures and subsidiaries. It is at present developing 7 Hydroelectric Power Projects and awaiting Government of India nod for 5 more projects.

Apart from incorporating a hydroelectric project from feasibility study to power generation business, NHPC provides consultancy services to other developing nations develop their hydroelectric power stations. NHPC also provides paid service as direct execution of project after earlier phases have been conducted by some other organization (generally in outside India). These international assignments are fast catching up with core business of NHPC.

In future, NHPC wants to diversify its operations in thermal energy, wind and solar energy.

Why are these bonds attractive?

- Promoter of these bonds is President of India through Ministry of Power. In other words, NHPC is a government of India Company.

- Credit rating for these bonds is ‘CARE AAA’, ‘[ICRA] AAA’, IND ‘AAA’ from CARE, ICRA and IRRPL, respectively.

- With interest rate being high, one may lock in the high interest rate for long duration (from 10 years to 20 years) before rates fall. I expect interest rates to fall to approximately half of the current in future (approximately 10 year later).

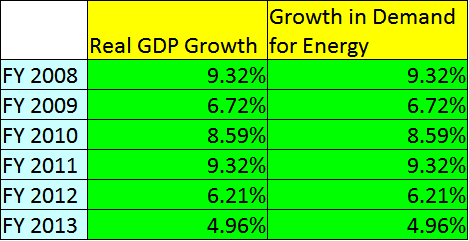

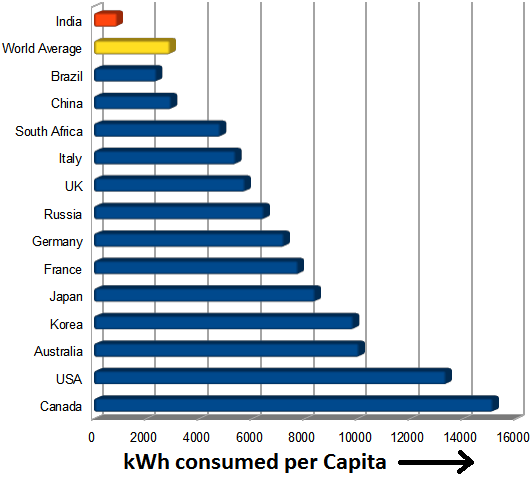

- NHPC being one of the major power companies will benefit with surge in energy demand. As per the prospectus, real GDP growth rate of India is same as growth in demand for energy. It is also an interesting fact that India has one of lowest energy consumption per capita and thus there is even greater scope for surge in energy demand.

India GDP Growth vs Demand for Energy

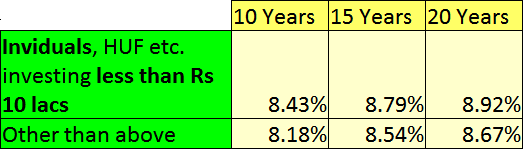

- Return on these bonds will be 8.43, 8.79, 8.92 per annum for retail investors investing upto Rs 10 lacs for tenures 10, 15, 20 years respectively. For all other investors, coupon rate will be 8.18, 8.54, 8.67 per annum for tenures 10, 15, 20 years respectively. Transfer of these bonds to non-retail investors will also change coupon rate to lower values.

- Interest on these bonds may be paid annually or at the end of selected tenure. Annual payment of interest can become additional income for investor. One may invest up to Rs 10 lac to qualify as retail investor and get the highest return. If one invests Rs 10 lac for 20 year tenure then that investor will get Rs 89200 in annual payout or Rs 7433 per month (there is no option of monthly payout). This amount can be quite descent income for many investors.

Risks

- Land Acquisition, Rehabilitation and Resettlement Bill 2011 may delay acquisition/development of land resources and may increase the cost of hydroelectric projects. At present, rehabilitation is based on National Rehabilitation and Resettlement Policy, 2007 (“NRRP”) of the GoI.

- River resources on which economically viable Hydroelectric Power projects may be developed in home country India are limited. Eventually those river access areas will become less available and thus growth for NHPC may slow down.

- The statement in prospectus “Our logo and name are not presently registered as trade or service marks in any jurisdiction” looks very risky from intellectual property standpoint.

- These bonds are not traded much on exchange (sometimes there is no transaction for days), thus, there may not be an easy exit once an investment has been made. The price of these bonds too remain generally at par with their face value. For example for bonds of face value Rs 100, the price generally goes up to Rs 100.5 (maximum I noticed was around 103).

Conclusion

If you have investible surplus and you can hold your investment for at least 10 years then these bonds are good investment instruments. You may download the prospectus from this link.