Buying Term insurance is vital for a person to ensure that his/her family is financially assured in the event of unfortunate. How should one determine the sum assured for Term Insurance? There are three methods of estimating sum assured.

Buying Term insurance is vital for a person to ensure that his/her family is financially assured in the event of unfortunate. How should one determine the sum assured for Term Insurance? There are three methods of estimating sum assured.

Human Life Value

Calculate how much a person will earn during his lifetime and subtract personal expenses in that duration. For example:

Consider that a person is 30 years old and earns a gross salary of 80,000 Rs per month, pays insurance premium of 10,000 per annum, personal expenses of 5,000 per month and tax of Rs 1,00,000 per annum. Retirement age is 60 years and assuming that salary and expenses both increase by 5% per annum.

Money available for saving or household expenses in 1st year= ((80,000 – 5000) * 12) – 10,000 – 1,00,000 Rs per annum = 7,90,000 per annum.

Number of earning years= 60 – 30 = 30

Total money earned during employment =$latex 7,90,000 * (\frac {100 + 5}{100}) ^{30} = 7,90,000 * 4.321942 = 34,14,334$

Thus, a person should take a term policy of sum assured 36,73,650.

Need Analysis

In this method one calculates the needs of family.

Consider a person’s household income excluding his own income is 70000 per month. His family’s monthly expenses are 100000. So monthly shortfall is 1,00,000 – 70,000 = Rs 30,000 per month. Expenses and income both increase by 5% so in 30 years, shortfall would be $latex 30,000 * 12 * (\frac {100 + 5}{100}) ^{30} = 3,60,000 * 4.321942 = 15,55,899 $ for lifetime.

Next calculate how much money will be required to pay for education of children, marriage and for any other financial plans such as retirement, renovating home etc.

Consider, 10,00,000 will be required for education of children, 10,00,000 will be required for marriage and 10,00,000 for spouse’s retirement in next 30 years.

Total money required = $latex 15,55,899 + 10,00,000 + 10,00,000 + 10,00,000 = 45,55,899 $

Thus, a person should take a term policy of sum assured 45,55,899.

Income Replacement Value

When a person is no more, other sources of income will fulfill the financial needs of a person. Income Replacement value is the percentage of one’s income that will be required to the family for a certain duration.

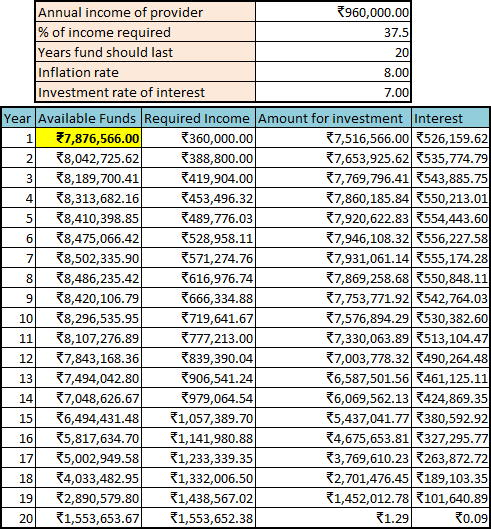

Consider that a person has an annual income of 80,000 per month and family needs 37.5% of his income for at least 20 more years until another member of the family starts earning or until some of the big expenses such as children’s education are met.

Refer to attached illustration on how much corpus will be sufficient to meet such need considering inflation and the amount invested. Refer here to an excellent article on Income Replacement Value.

Income Replacement Illustration

Among the methods described above Need Analysis is most accurate method as all the needs that a person may have are given a thought and then requirement is determined.