When we go to a restaurant, we choose the best seat available, choose the best food available, get the food and service customized to the best of our liking, but when bill comes, we look at the total, pay the bill and walk out. Do you really pay attention to the restaurant bill?

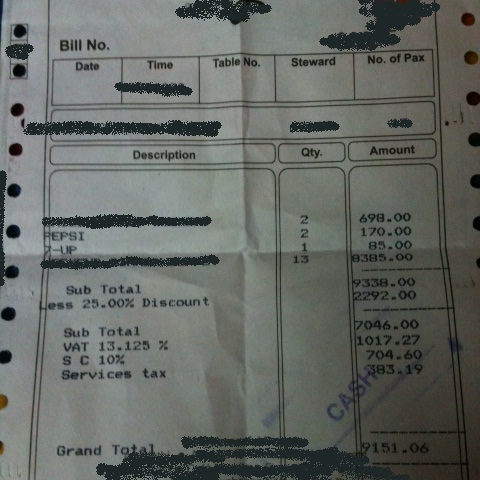

Components of a restaurant bill

- Bill for the menu items – This the portion that most of us generally check and work out with waiters if there is any discrepancy – oh did we order this lachchha paratha, didn’t we order half butter chicken instead of full?

- VAT (Value Added Tax) – VAT ranges from 5 to 20% for different states in India. It generally ranges from 12.5 to 15%. VAT is charged on the total food bill including service charges. VAT is different for food and liquor so request for separate bills for food and liquor.

- Service Charges – Restaurants generally charge 5 to 20% of the total bill as Service Charges. These charges are mandatory tip to waiters and kitchen staff, provided restaurant menu clearly and prominently declares it. However, a customer may request restaurant to reduce or eliminate this component from restaurant bill.

- Service Tax – Service Tax is imposed on the service portion of the food bill. Service tax stands at 12.5% of the service component of the bill. Service component of a bill is generally 40% of food bill + service charges. However, many restaurants add food bill and service charges, and then calculate 40% to arrive at service charges. This gives an advantage of 0.75% of total food bill to customers if service charge is 10% of food bill.

- Tip – Customers are not required to pay tip if service charges have already been included in the bill. However, if customer feels delighted by the food and service then restaurant staff happily accepts tip.

Next time when you dine out, look closely at bill.

Pingback: How to Save on Your Household Expenses? » FinHow