Pension Fund Regulatory Development Authority (PFRDA) has launched a separate National Pension Scheme (NPS) module for employees of corporations including PSUs. NPS is good for corporate employees and it is easy for corporations to adopt it.

Benefits of NPS to corporations

- Corporations can give incentive to employees by giving pensions using NPS.

- Corporations need not manage pension records and pension fund. The whole process is the responsibility of different stakeholders and the overall oversight responsibility lies with PFRDA.

- Government will not be overwhelmed by pension expenses because pension fund management will be just like other fund management. Any loss of capital will need to be borne by individuals/corporations that make investment decisions on pension funds.

- Corporations can claim tax rebate on the amount it contributes (limit of 10% of basic salary + Dearness Allowance) to employees. This amount will be considered in Business Expenses

Benefits of NPS to employees

- Employees may choose the allocation of their fund in various market instruments with certain restrictions. Pension Fund Manager (PFM) can choose standard investment proportions to various funds depending upon the age of employees.

- Employees may choose their PFM if their employee gives them such an option

- An employee gets single Permanent Retirement Account Number (PRAN) irrespective of the place of employment or the employer.

- PFM will release daily NAV so that an investor may be well informed.

- In Tier 1 contribution (employees cannot withdraw until age of 60 years), Employees’ contribution in NPS will be eligible for tax deduction in section 80CCD(1) within overall 1 lac limit. Employer’s contribution in NPS for an amount upto 10% of basic salary + DA is tax exempt and this is beyond 1 lac limit.

- In Tier 2 contribution, employees may withdraw investment as per the requirement.

- There is an option to remain invested even after retirement.

How does NPS work?

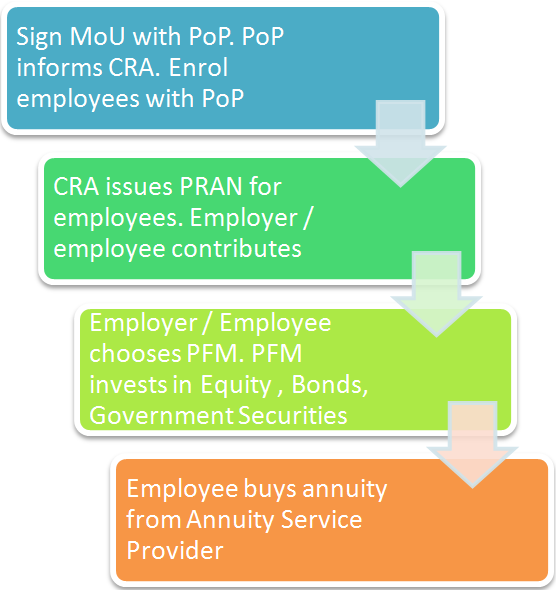

- Corporations choose a PoP (Point of Presence) and sign an agreement to perform pension services for a predetermined fees on per transaction or lump sum basis within defined SLAs (Service Level Agreements). PoP are financial institutions that will provide a means to perform transactions such as deposit of money in pension fund, submission of KYC, change of details of employee, addressing grievances, means to withdrawl of pension fund. Examples of PoP is Allahbad Bank, Punjab National Bank, State Bank of India, ICICI Bank etc.

- PoP shall inform CRA (Central Recordkeeping Agency) and organization information as well subscriber details. CRA shall issue PRAN for individuals. National Securities Depository Limited (NSDL) will be CRA for NPS.

- Contributions from employees will be deposited with Trustee Bank. Trustee bank will be Bank of India.

- Employer chooses a Pension Fund Manager (PFM) or gives an option to employees to choose their PFM. PFM invests employees funds in various investment instruments as per the choice of employees or auto select option (a predefined percentage of investment in various instruments based on age of investor). Examples of PFM is SBI Pension Funds Pvt. Limited, LIC Pension Fund Limited, UTI Retirement Solutions Limited

- At the time of retirement, employee buys annuity from Annuity Service Provider. Examples of Annuity Service Provider is Life Insurance Corporation of India, SBI Life Insurance Co. Ltd., ICICI Prudential Life Insurance Co. Ltd., Bajaj Allianz Life Insurance Co. Ltd. etc.

For the list of intermediaries such as PoP, PFM and ASP, please check PFRDA website.

Conclusion

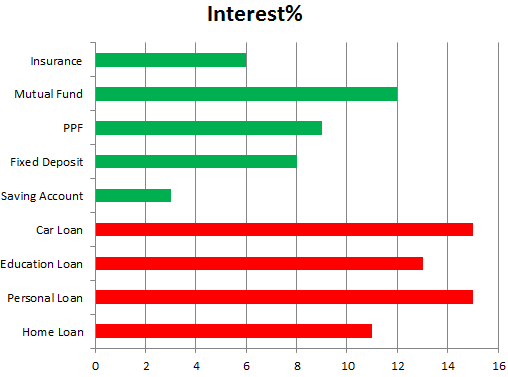

In NPS, specialized organizations handle particular tasks and employees get the option to choose their fund manager and investment option. NPS is administered by a Trust that comprises of people from all walks of life. NPS has given a return of over 10% recently and an essential part of financial planning is to secure one’s financial future viz retirement planning. These factors make NPS a good investment option. If you work for a corporation that has not yet enrolled for NPS then it may be the time you ask your employer to enrol in NPS.

Reference: PFRDA website